Many people will do historical backtesting, because backtesting can see the quality of an EA, so that you can have a deeper understanding of your own trading strategy, but sometimes the effect is very good when the backtesting is performed, and when it is real It is also inconsistent with the back-test, and even in the back-testing with different data accuracy, there will be inconsistencies.

Why does this happen? Assuming that only the moving average is used to open and close a position, there is a trading strategy that opens a long position when the short-term moving average crosses the long-term moving average, and crosses down to close the long position. Such a trading strategy uses control points, real-time prices, and the results of the opening price back-testing are all consistent, and the use in real trading is also the same, because this strategy uses very low data accuracy, and it only uses it when it crosses. The opening price, it does not use very fine data.

The most accurate data of MT4 is based on one-minute high opening and low closing prices. There is no more detailed data on how the K-line moves this minute(MT5 data accuracy is more, tick data is the data of each quotation, then there will be no difference between MT5 backtest and real price).

Then there may be such a situation. After the backtest is opened, there is a moving average cross and liquidation during the current cycle of K-line fluctuations, but after the K-line is completed, there is actually no cross, then this order is not Will be stopped. In the firm order, the long order will stop the loss.

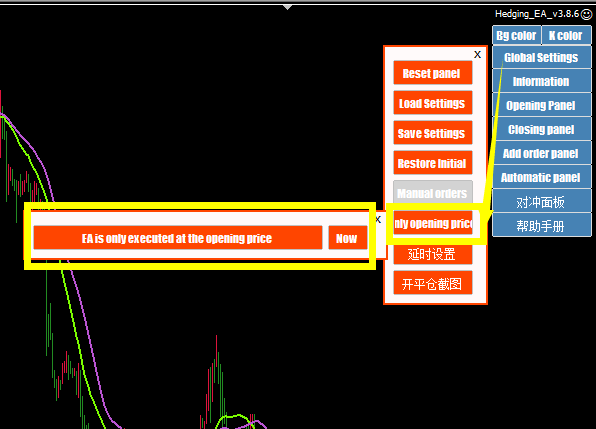

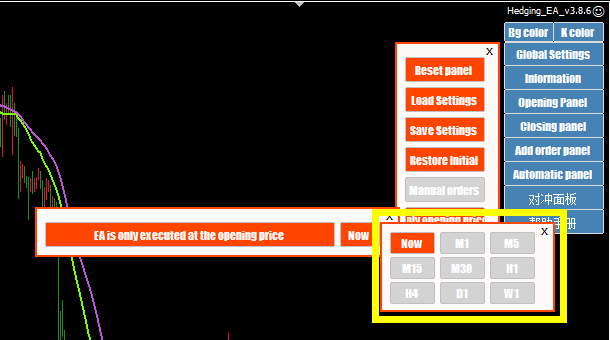

So if your strategy uses more refined prices, there will be inconsistencies between the backtest and the real market. This is the difference between the backtest and the real market. How to solve this problem? Select “Only opening price only” in the “Global Settings” of the EA. The period can be selected. After turning on this function, the EA only uses one data for the opening price, no matter how the EA moves in the market, only one data for the opening price, so that the accuracy of the data can be artificially reduced by the EA setting.