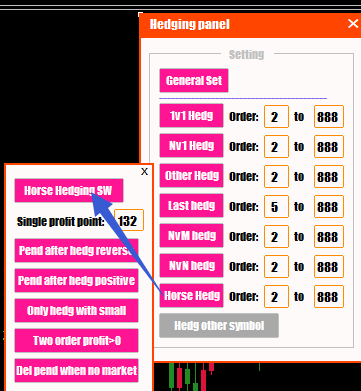

Please see Tian Ji Horse Racing Story:https://www.huayue119.com/etagid131250b0/

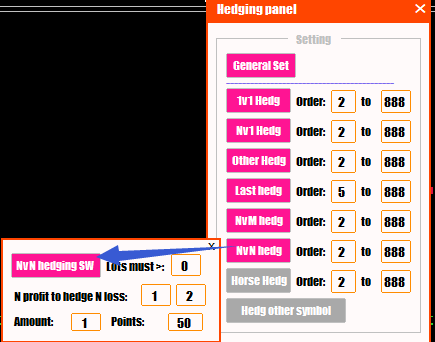

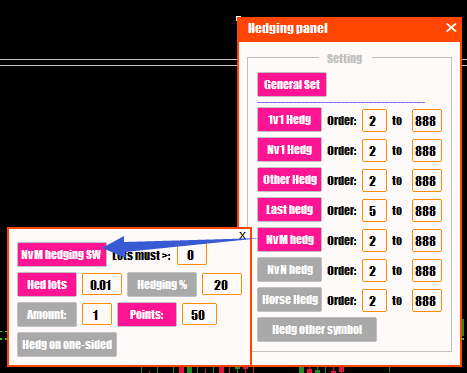

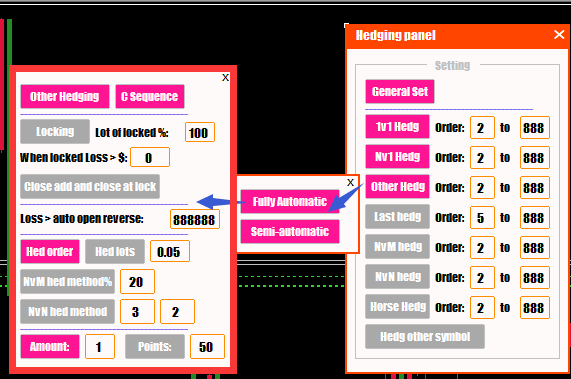

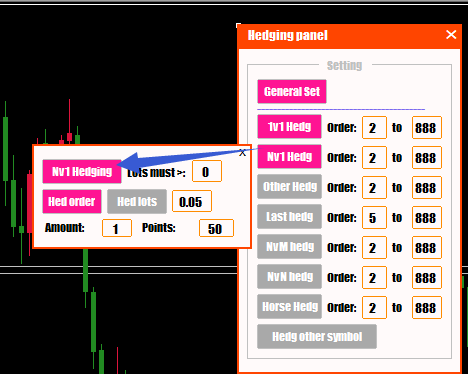

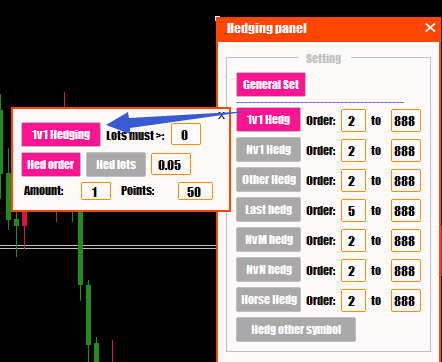

Order( 2)to(888 ):When a one-way order is hedged, the quantity is valid in this input box range.

Horse hedging SW:Horse Hedging control switch;

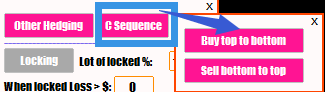

The bottom profitable buy order hedges the top loss order,or the top profitable sell order hedges the bottom loss order;

Single profit point:Custom Horse hedging closing interval;

Pend afer hedg revers:When a reverse order is hedged, pen a buy or sell stop order for the same position at the same point;

Pend after hedg positive: When a positive order is hedged, pen a buy orsell limit order for the same position at the same point;

Only hedg with small: Hedge only the smallest lots order;

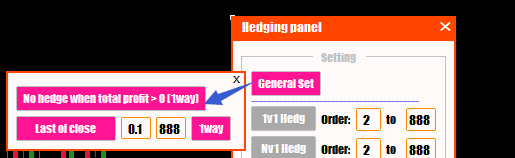

Two order profit>0:The profit of the two hedged orders is greater than 0;

Del Pend when no market:Delete pending orders when there is no market order.