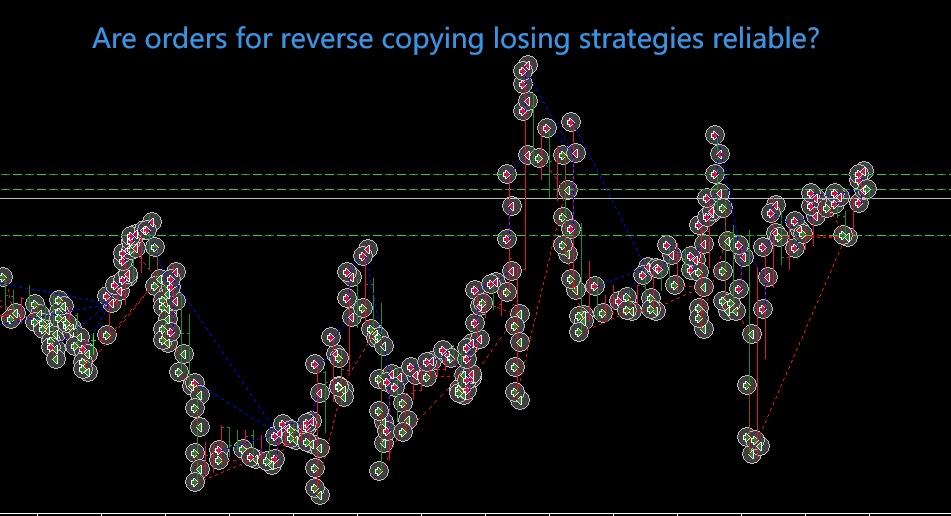

During the previous 10 years of simulated trading, a constant trading strategy made steady losses, and in the process, it was strictly executed according to its set trading strategy.

In the future market, the probability of loss is definitely very high, and it may also be a loss.

If we follow the trading strategy in reverse, can we make money by trading?

That is to say, this strategy opens buy orders and closes sell orders, I will open sell orders and close buy orders; if the strategy opens sell orders and close buy orders, I will open buy orders and close sell orders; if this strategy takes profit, I will stop damage.

If you do this in reverse, it is sometimes feasible, but you must pay attention to the following points in the process:

1,The strategy of small take profit and large stop loss is not feasible;

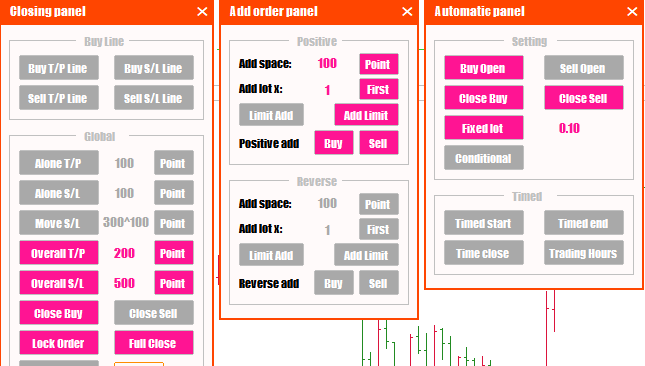

For example, there is such a strategy: I predict that the next EURUSD will have a bullish trend, enter a long order of 0.1 lot at the current price, and increase the position equidistantly by 100 points, the increase multiple is 1, and the order in one direction is 200 points. Take profit , 500 points stop loss;

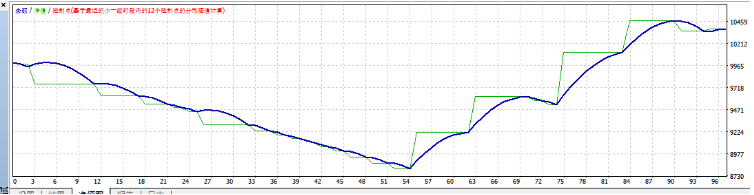

Use Hedging EA to set the parameters, let’s randomly choose a period of time to test and verify: test time 2012.1.1-2012.1.31

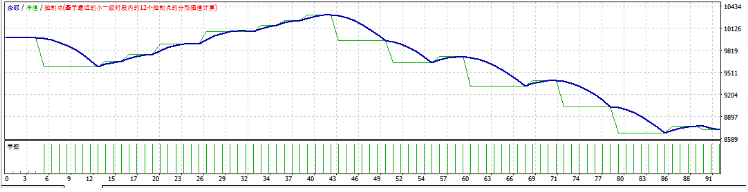

The test results are as follows:

Reverse this strategy: enter the current price with two long and short orders of 0.01 lots each. Both against the trend and the trend are equidistant to increase the position by 100 points.

From the above test results, it can be seen that the forward loss is close to about 1500$, and the reverse copy order earns about 400$. The profit and loss are not proportional, so it is not desirable;

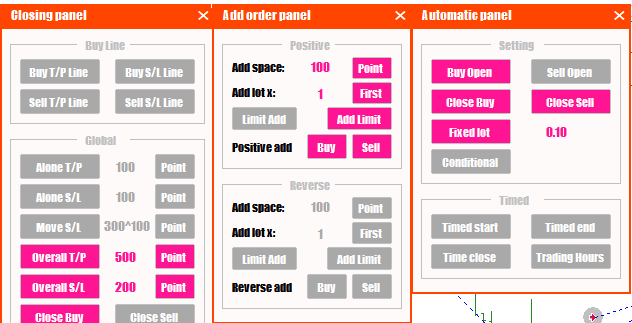

2,The impact of transaction costs, the reverse copy order will lose 2 times the spread. If you don’t understand it, you can understand it by drawing two lines at the top and bottom.

Anyone who has done a transaction should know the transaction cost, that is to say, when a buy order enters the market at the current price, the transaction price is the bid price (the price above), and the current price closes the sell order, and the transaction price is the bid price. The point is to enter a buy or sell order at the current price and close the order immediately, then you will lose a transaction cost.

For example, enter a long order of 1 standard lot at the current price, and the profit will be 200 points.

Reverse copying a sell order, when the buy order is closed with a profit of 200 points, the number of points lost in the sell order = 200 points + 2 times the transaction cost;

It can be seen from the above results that if it is a strategy of frequent trading and reverse copying, the handling fee will defeat you.